Stonk O Tracker is a website for tracking public stocks. Traders, both experts and beginners, use it to make trading easier.

Introduction

In the fast-paced world of stock trading, having access to efficient tools and having them guide you throughout your trading journey is bound to make you a better trader. Unfortunately, such tools do not exist, or even if they exist, they are too expensive for beginners.

Today, we introduce you to a trading tool that has taken the stock trading market by storm, and everyone is talking about it.

Enter “Stonk-O-Tracker,” a unique and valuable resource for both novice and experienced traders alike.

In this article, we will explore the key features and functions of Stonk-O-Tracker, shedding light on how it can benefit traders. We’ll also discuss its limitations and how it complements other tools like iBorrowDesk, which monitors borrow rates on stocks for short-selling.

Stonk O Tracker – Explained

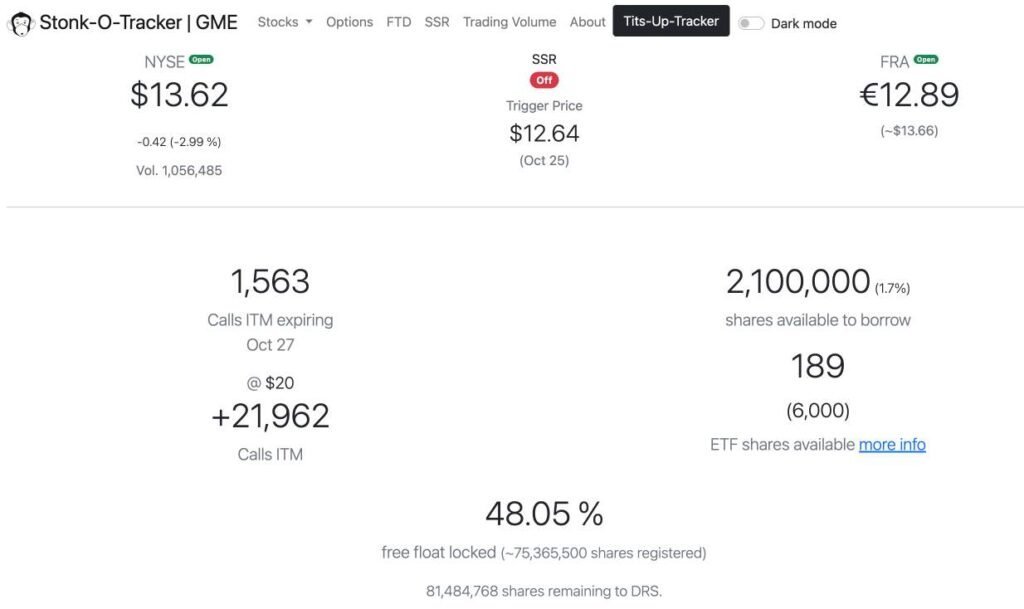

Stonk O Tracker is a stock monitoring tool that shows information regarding stock prices, Short Sale Restriction (SSR) data, borrowable and shortable shares, shorted volume and calls In The Money (ITM) for some specific stocks.

Back in the day, this tool was made specifically for tracking stock data of the television channel AMC Entertainment Holdings (AMC). It then expanded to GameStop (GME), and now covers many popular stocks.

Key Features of Stonk-O-Tracker

- Current Stock Prices: Stonk-O-Tracker shows you the current prices of stocks like GME and AMC in real time. This helps traders keep an eye on their trades and make smarter decisions based on the latest market values.

- Short Sale Restriction (SSR) Information: SSR is important for stocks like GME and AMC. Stonk-O-Tracker lets you know if the SSR rule is in effect; this rule stops too much short selling when a stock falls a lot to avoid more drops.

- Borrowable and Shortable Shares: Traders need to know how many shares they can borrow to make money when stocks fall. Stonk-O-Tracker might tell them this, helping them understand what other traders are doing.

- Shorted Volume: This data shows how many shares traders have borrowed to bet against a stock. It helps predict market bias and if there might be a sudden rise in price or lots of price changes.

- Calls In The Money (ITM): Stonk-O-Tracker can show ‘In The Money’ call options; it means that the option’s stock price is below the current stock price which may help traders decide their next move.

How to Use Stonk-O-Tracker as a Beginner?

Here’s a beginner’s step-by-step guide on how to use Stonk-O-Tracker:

1: Access the Stonk-O-Tracker Website on your preferred web browser.

2: Explore the Homepage – You’ll see information about the GME and AMC stocks

3: Check Current Stock Prices – Stonk-O-Tracker displays real-time or near-real-time stock prices. Look for the current prices of GME and AMC.

4: Understand Short Sale Restriction (SSR) Status: Determine if SSR rules are active for GME and AMC. If SSR is in effect, it may limit short selling when a stock’s price drops significantly.

5: Review Borrowable and Shortable Shares: You will find borrowable shares data for market insight which helps you understand market sentiment. (and potential short-selling opportunities.

6: Check Shorted Volume: Stonk-O-Tracker provides information about the volume of shares that traders have sold short. This can offer insights into market sentiment and potential price movements.

7: Investigate ITM call options (if there are any available at the moment).

8: Explore the ETF Data

Do keep in mind that you cannot trust data from a single source. Always cross-check the values from other sources as well so that you’re making a calculated decision.

By using the insights provided by Stonk-O-Tracker and other valuable sources, your trading decision will be more calculated and you will be more confident of wins.

Stonk O Tracker’s Recent Expansion to ETF Tracking

Since its inception, Stonk O Trader has been used for several purposes, but luckily, the tool is growing to have more and more features and cover more stocks. Its recent expansion to ETF Tracking is a big example.

The recent update to Stonk-O-Tracker, where it now monitors GameStop (GME) shares tucked away in the top 14 Exchange-Traded Funds (ETFs), holds significance for traders due to various factors:

- Diversification of Trading Insights

- Identifying Hidden GME Exposure

- Market Impact Assessment

- Risk Management

- Opportunities for Arbitrage

Basically, Stonk-O-Tracker now shows how GameStop links to other investments. This helps traders make smarter choices, stay safer, and find new trading chances.

iBorrowDesk vs Stonk-O-Tracker – Who Wins?

here’s a side-by-side comparison of Stonk-O-Tracker and iBorrowDesk:

| Stonk-O-Tracker | iBorrowDesk |

| Tracks GME and AMC stocks with additional data on stock prices, SSR status, borrowable shares, shorted volume, calls ITM, and ETF data. | Specializes in providing borrow rates and available shares for short selling across various stocks. |

| Offers a broader view of specific stock performance and market sentiment. | Primarily focused on borrow-related information, ideal for short-selling strategies. |

| Useful for traders seeking a holistic view of specific stocks and their connection to ETFs. | Valuable for traders primarily focused on short-selling strategies. |

| Limited by its focus on specific stocks (GME and AMC). | Offers detailed and up-to-date borrow-related data but may provide less information on other stock aspects. |

| Versatile for various trading needs. | Specialized for traders primarily interested in borrow rates. |

Your choice between the two depends on your trading objectives and whether you prioritise a broader view of stock performance or specialized borrow-related data for short-selling strategies.

Stonk-O-Tracker limitations

Limited Stock Coverage: Primarily focuses on GameStop and AMC, omitting other stocks.

Data Source Dependency: Relies on Interactive Brokers data, potentially limiting data variety.

Diversify Sources: It’s crucial to use multiple sources for comprehensive market insights.

Final Words

In conclusion, the Stonk-O-Tracker is a valuable tool for traders; it offers real-time trading data on specific stocks, which helps traders make better decisions while trading. Despite minor drawbacks and limitations, it aids in risk management and decision-making.

However, always remember to diversify information sources for a well-rounded trading strategy.

Suggested Reads:

SQM Club – Saving the Environment For Future Generations

TheApkNews.Shop – Why is the Health & News Magazine Down?